Dow Releases Q4 2023 Financial Results, Sales Drop 10% YoY

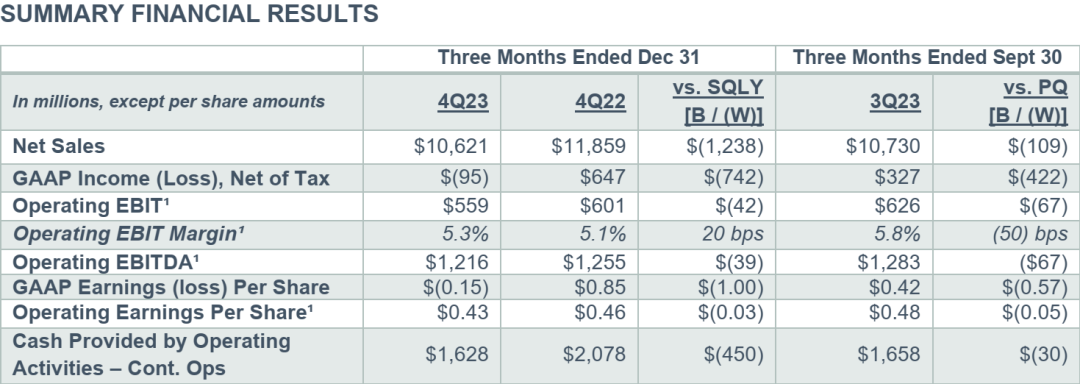

On January 25, 2024, Dow Chemical Company released its Q4 2023 financial report, indicating a decrease in net sales by 10% year on year to $10.621 billion (approximately CNY 762.31 billion). The company's earnings before interest, taxes, depreciation, and amortization (EBITDA) also declined by $42 million to $559 million (around CNY 40.12 billion).

The report disclosed that Dow's net sales for the full year of 2023 amounted to $44.6 billion (approximately CNY 3.201 trillion), representing a decrease of 21.6% compared to the previous year's net sales of $56.9 billion. Additionally, the company's EBITDA dropped by 57.6% to $2.8 billion (around CNY 201 billion) compared to $6.6 billion in 2022.

The global economic downturn, reduced end-market demand, and declining product prices were cited as the primary factors responsible for the performance decline across Dow's three major business segments.

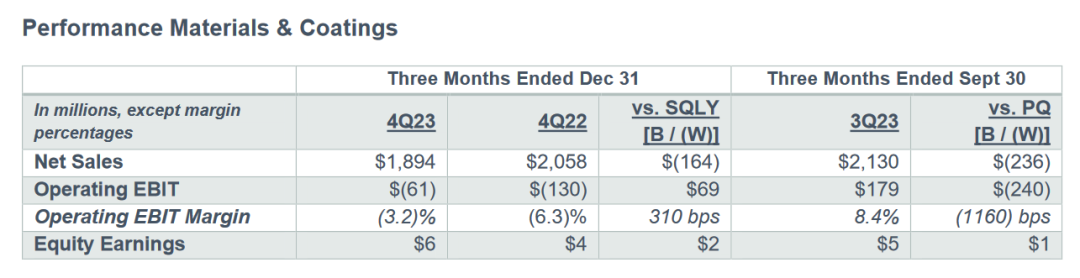

1. Performance Materials & Coatings: In Q4 2023, this segment recorded a net sales decrease of 8% to $1.894 billion and incurred an EBITDA loss of $61 million. The decrease in net sales was primarily attributed to lower prices of silicones, coupled with weak demand and seasonally lower volumes.

2. Packaging & Specialty Plastics: The net sales for this segment in Q4 2023 reached $5.6 billion, reflecting a 7% decline. However, the EBITDA increased by $9 million to $664 million. The decrease in net sales was attributed to lower local prices, along with seasonally lower volumes in the construction and transportation coatings end markets.

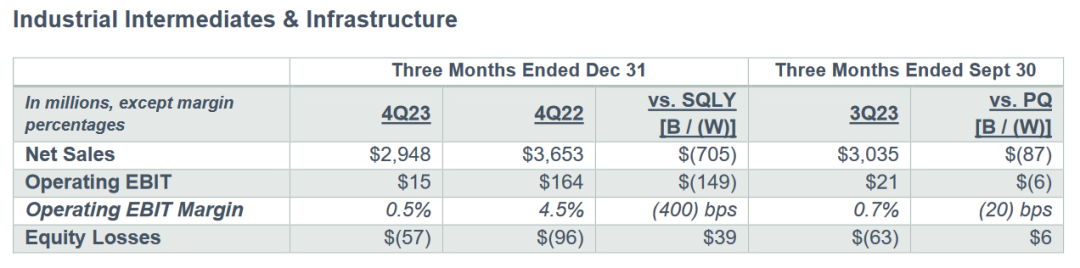

3. Industrial Intermediates & Infrastructure: In Q4 2023, this segment reported a net sales decrease of 19% to $2.9 billion, resulting in an EBITDA of $15 million, down from $164 million in the same period last year.

Dow CEO Jim Fitterling acknowledged the challenging global environment and praised the company's team for driving operational and investment strategies amidst complexities. He highlighted the improvement in year-over-year sales volumes, strong cash flow, high conversion rates, and significant shareholder returns. Fitterling also emphasized Dow's cost advantages, leadership position in end markets, and strategic investments, expected to generate sustainable value.

Since 2023, Dow has implemented cost-reduction measures such as plant closures and workforce reductions. The company remains committed to improving product utilization and sustainability. Notably, Dow partnered with Circusil LLC to establish the first silicone recycling facility in Kentucky, USA, aiming to achieve $3 billion in annual basic earnings.

This news highlights the challenges faced by Dow Chemical Company with regards to declining sales and the proactive measures undertaken to address them, including cost-saving initiatives and sustainability efforts.